Het pensioen voor zzp'ers

pensioen, eindelijk makkelijk.

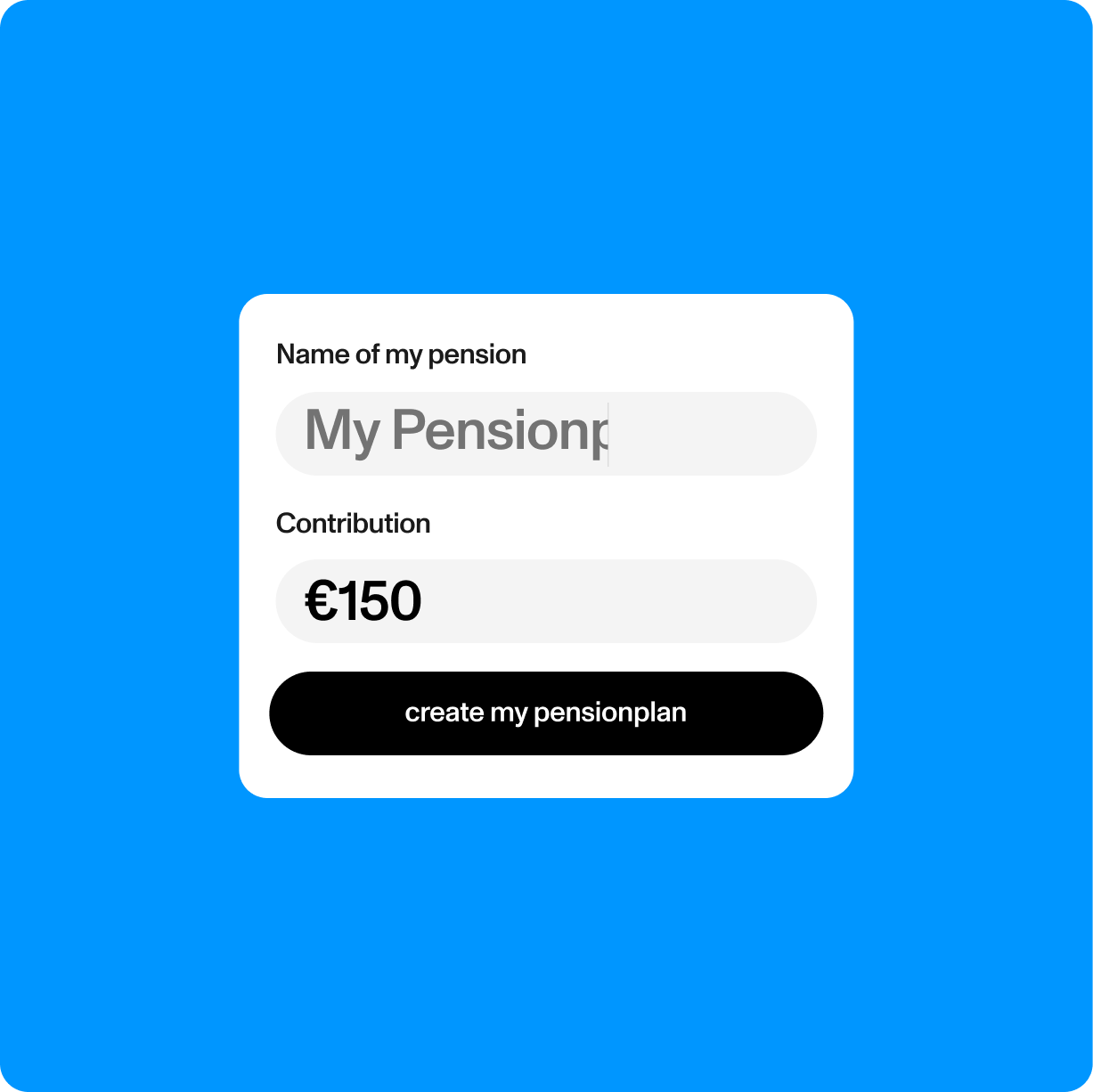

In drie stappen van niets, naar pensioen.

Bij Vive houden we van makkelijk. Dus Geen ingewikkelde financiële planning, geen uren aan onderzoek. Gewoon een heldere manier

om geld op te bouwen voor later. Allemaal via één simpele app.

Meld je aan voor een account

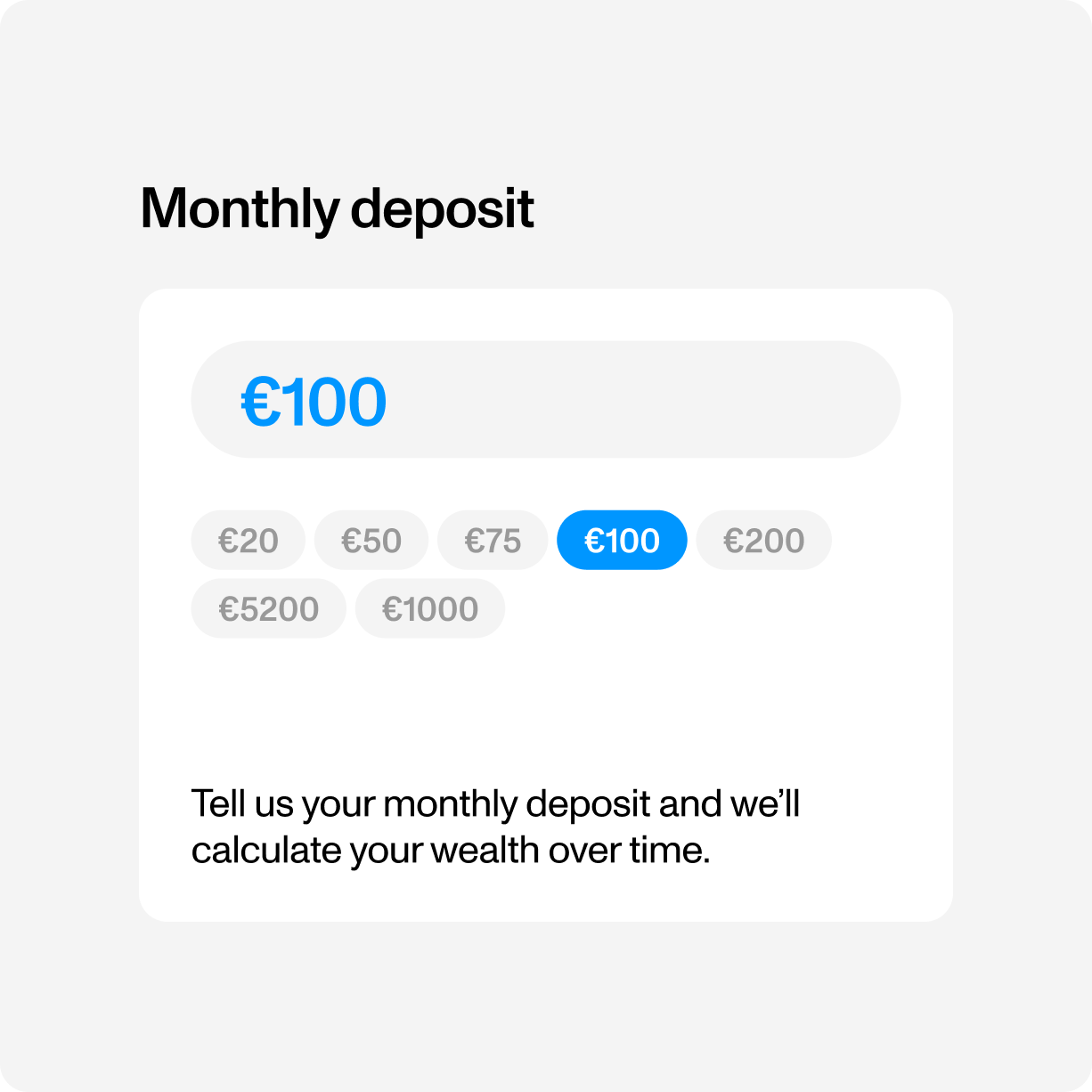

Als je een pensioenregeling bij Vive neemt regelen wij de app en de pensioenrekening voor je. Zo ben je binnen no-time aan de slag met pensioen en dat geheel fiscaal voordelig. Daarna is het aan jou. Hoeveel wil je opzijzetten en wanneer? Wacht je tot het einde van het jaar, of leg je per maand in? Elke vorm van inleggen is mogelijk.

Automatische beleggingsstrategie

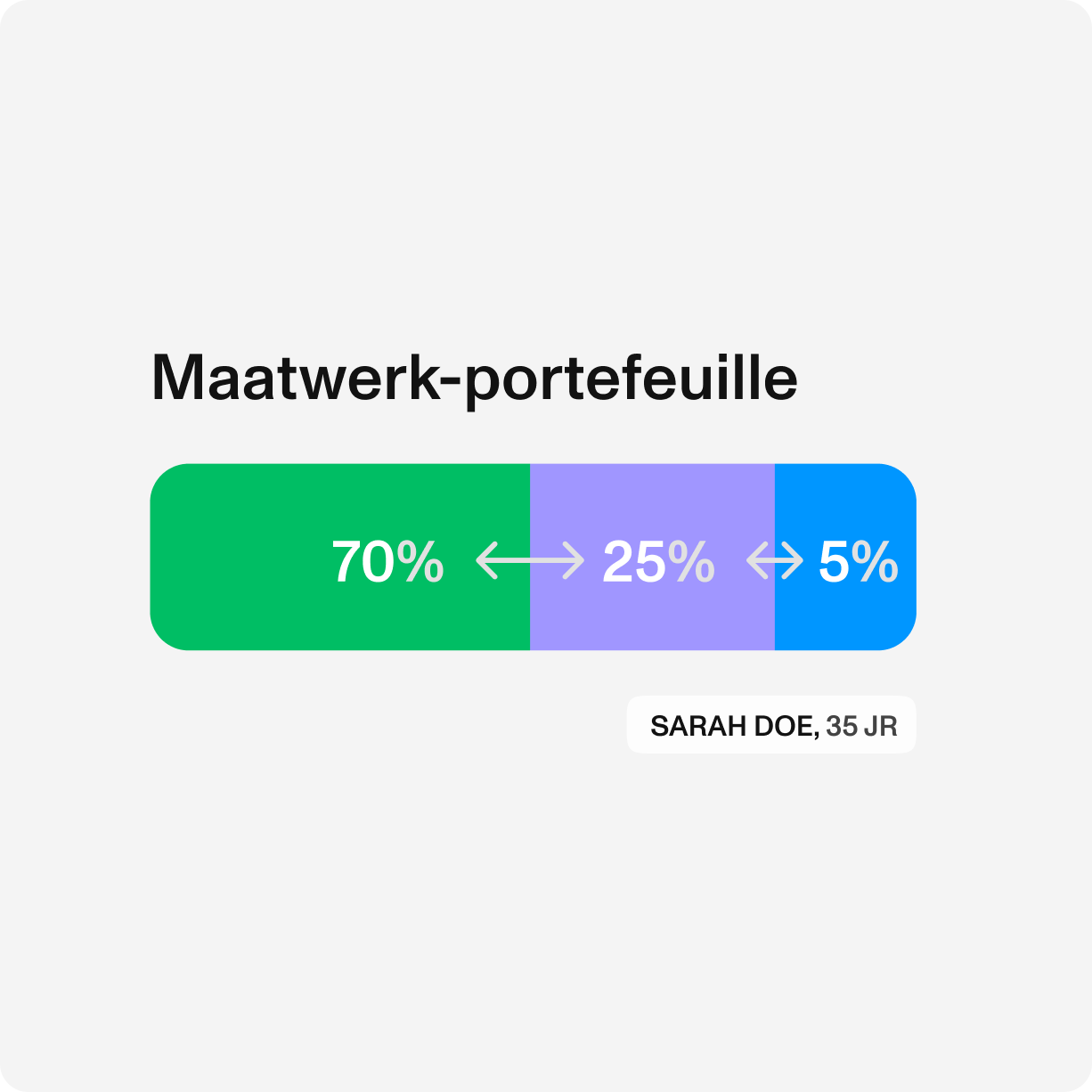

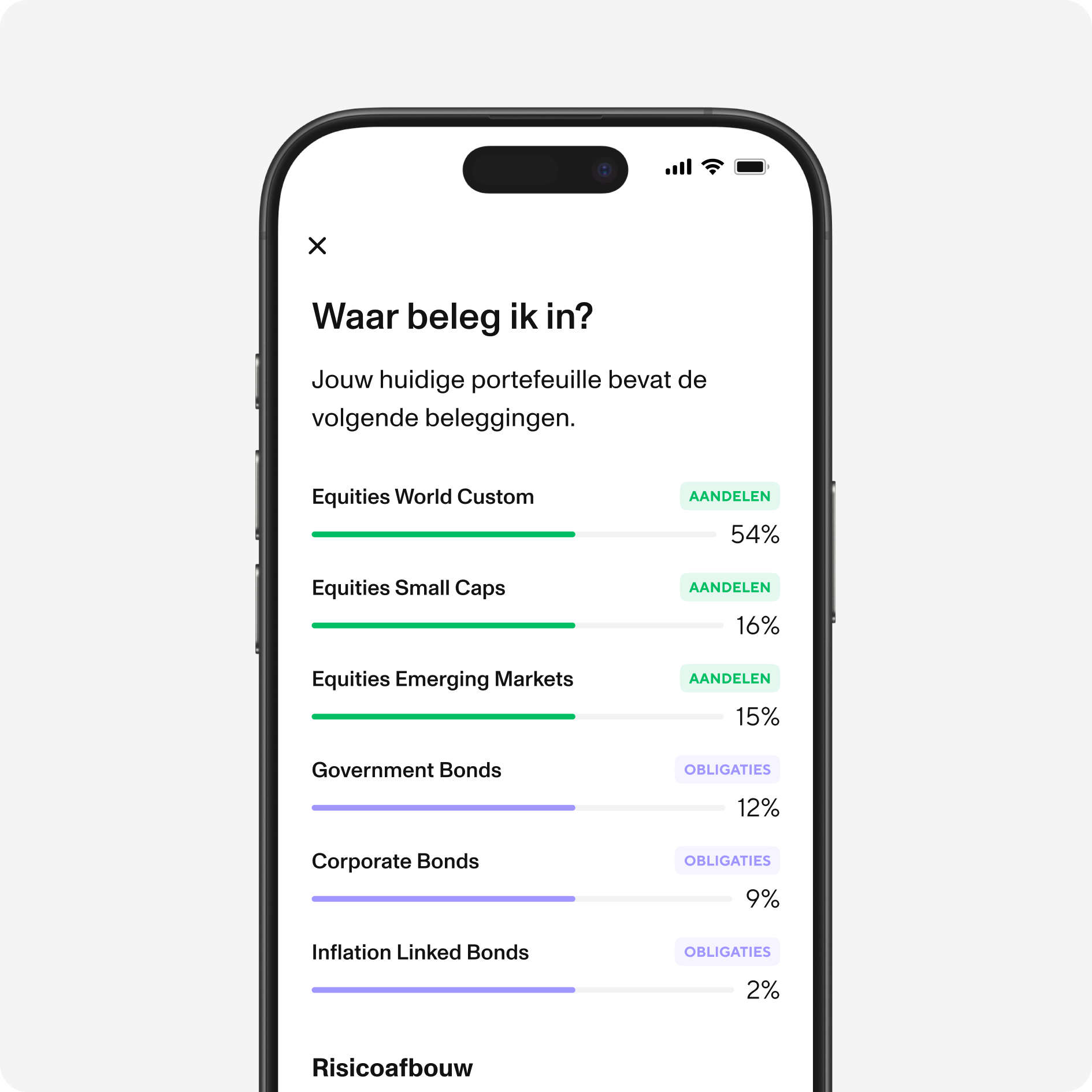

Nadat je hebt ingelegd gaat jouw geld gaat slim aan het werk. Op basis van jouw leeftijd en financiële situatie maken wij een persoonlijke beleggingsstrategie. Het geld wat je erin stopt, wordt vervolgens automatisch belegd. Ook past de strategie zich automatisch aan naarmate je dichter bij je pensioenleeftijd komt. Jij hoeft er niet naar om te kijken.

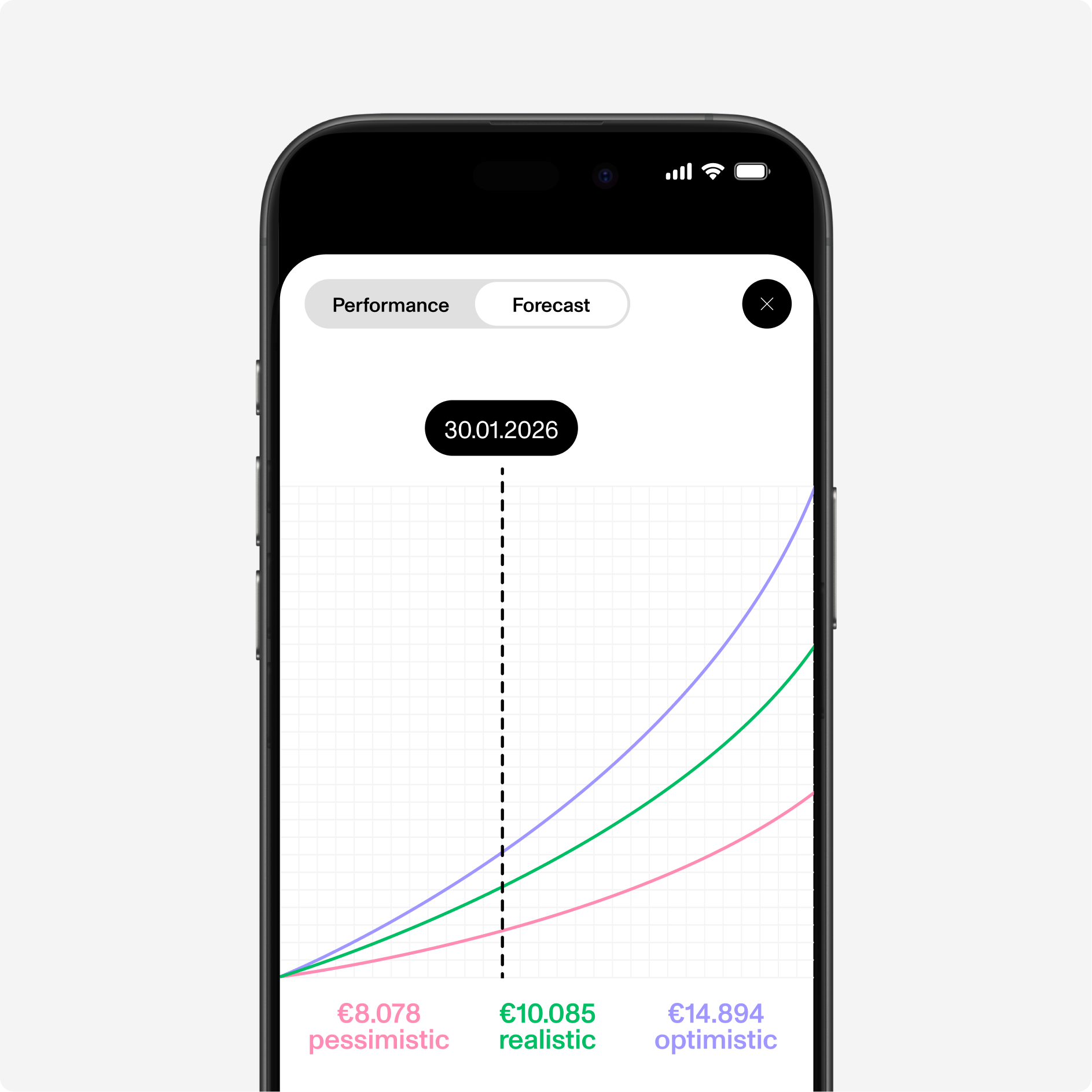

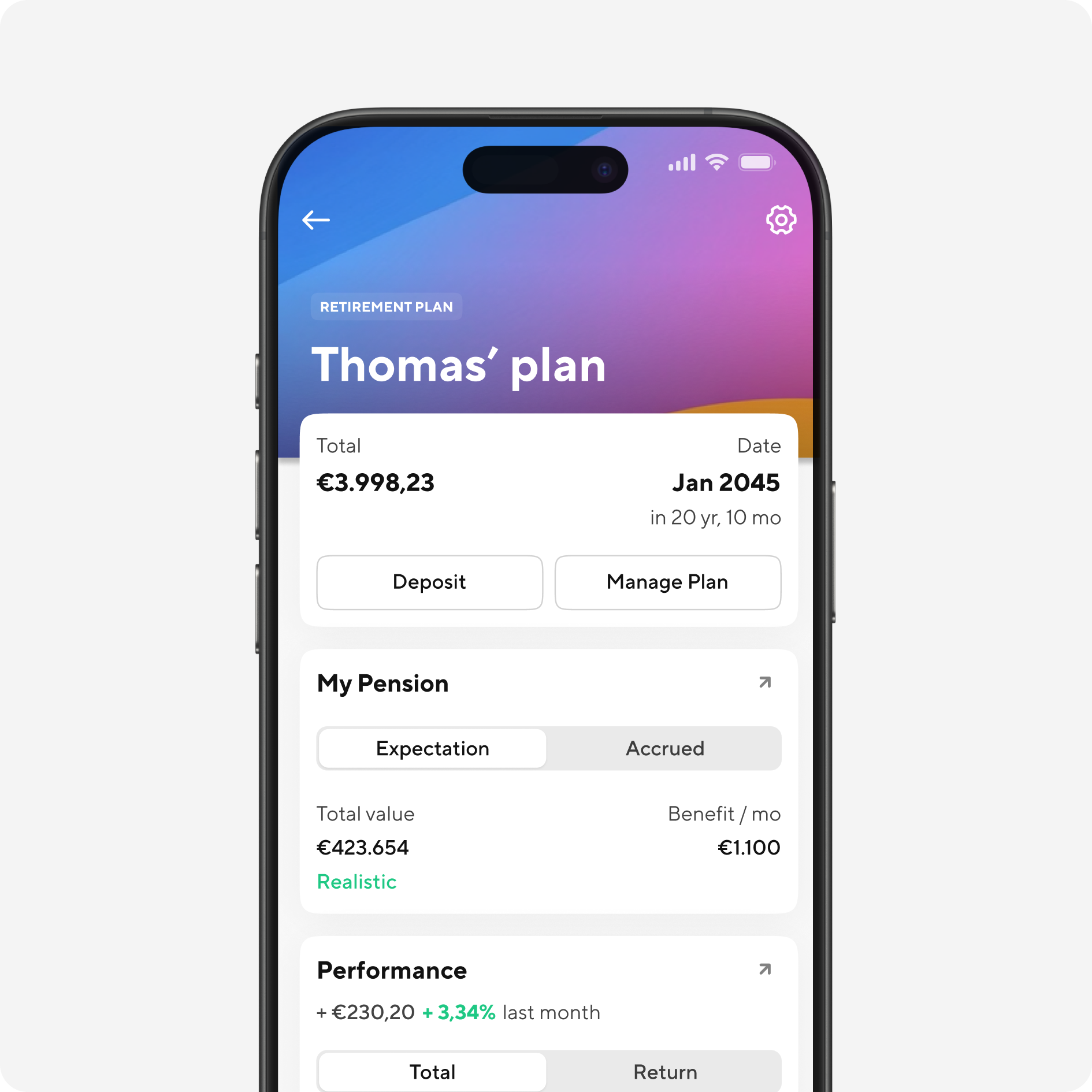

Volg je voortgang

Altijd inzicht, nooit gedoe. Via de app zie je precies hoe je geld groeit. Wil je meer inleggen of juist minder? Dat regel je in een paar tikken. Jij houdt de controle, zonder dat het tijd kost.

Waarom Vive perfect past bij jouw leven.

Eindelijk een manier om slim vermogen op te bouwen die past bij hoe jij werkt: efficiënt, inzichtelijk, onder jouw controle.

Tax benefit

Wat je inlegt, trek je af van je belastingen. Dat scheelt direct geld in je portemonnee. En je geld groeit belastingvrij verder tot je het nodig hebt. Slimmer dan alleen sparen, veiliger dan alles in je bedrijf stoppen.

Automatisch

Eenmaal opgezet, altijd geregeld. Je stelt het één keer in, de rest gaat automatisch. Elke maand wordt het afgeschreven, slim belegd, bijgehouden. Jij kunt focussen op waar je goed in bent, terwijl je geld voor de toekomst groeit.

Gespreide risico's

Niet alles op één paard zetten. Door naast je bedrijf ook privévermogen op te bouwen, spreid je je risico's. Als ondernemer weet je: diversificatie is slim. Dit geldt ook voor je persoonlijke vermogensopbouw.

Interesse in onze oplossing? Kom in contact

Technologie die met je meedenkt en beweegt.

Alles wat je nodig hebt om je toekomstgeld te regelen. Zo ben je later meer verzekerd van een goed pensioen.

Everything in one app

Je persoonlijke cockpit. Met één blik zie je hoeveel je hebt opgebouwd, wat er maandelijks binnenkomt en waar je naartoe werkt. Alles realtime, altijd up-to-date.

Fiscaal voordelig

Je inleg voor pensioen is aftrekbaar van jouw inkomen, het opgebouwde pensioen telt niet mee voor de vermogensbelasting en je krijgt een gedeelte van je inleg terug van de belastingdienst. Zo houd je netto meer over en werkt er meer geld voor jouw toekomst.

Dynamisch aangepast

Je beleggingen bewegen automatisch mee met de markt én jouw leven. We herbalanceren op basis van jouw situatie, de persoonlijke strategie van het pensioen (of ander beleggingsplan) en bouwen het risico richting je pensioen stap voor stap af. Zo behoudt je zoveel mogelijk waarde, zonder dat jij iets hoeft te doen.

Meer weten over pensioen zzp'er?

Onze gratis pensioenbrochure helpt je eenvoudig te begrijpen hoe je als zzp’er pensioen opbouwt met Vive.

Hoe je pensioen via Vive volledig in één app regelt

Hoe eenvoudig en snel ons onboardingproces werkt

Hoe we een scherpe prijs bieden, zonder verborgen kosten

Nog niet overtuigd van onze manier van beleggen?

Bekijk hoe onze app jouw geld aan het werk zet voor later, via pensioen of vrij beleggen. We zetten jou centraal met persoonlijke beleggingsplannen; de tijd van algemene oplossingen is voorbij. Jij kiest je doel, wij doen de rest: automatisch beleggen, slim herbalanceren, géén losse trades of aandelenselectie.

Bekijk hoe onze app werkt

In 1–2–3 je pensioen geregeld

€7.50 p.m.

0.35% p.j. vermogensbeheerkosten en €7.50 p.m. voor service en support.

maak een afspraak

Klaar voor een moderne oplossing voor pensioen of vermogen? Maak vrijblijvend kennis met Vive en ontdek wat kan - voor jouw organisatie.

Complex pensioen, simpel uitgelegd - weet direct waar je staat

Persoonlijk gesprek voor jouw situatie en die van je werkenemers

In 30 minuten meer duidelijkheid dan uren googlen

Alle ruimte voor vragen aan onze ervaren pensioenexperts

Frequently Asked Questions

Alles wat je nodig hebt. In één app. Op één plek. Alle doelen en strategieën, altijd bij de hand.

What is a good pension?

Pensioen is het inkomen dat je ontvangt nadat je bent gestopt met werken. Het pensioen waar ieder persoon comfortabel van kan leven verschilt per persoon. De hoogte ervan hangt af van jouw persoonlijke levensstandaard, wensen, en de kosten die je verwacht te hebben tijdens je pensioen. Een ruwe rekensom voor het bepalen van het bedrag wat je tijdens jouw pensioen nodig hebt, is de volgende manier:

- Je rekent of bepaalt hoeveel je wilt per maand.

- Dat doe je keer 12 (aantal maanden in het jaar)

- Dat bedrag keer 20 (makkelijk te rekenen pensioenjaren)

Nu heb je een schatting van het totale bedrag aan pensioen dat nodig is voor later. Dat is een ruwe rekensom voor goed pensioen.

Welk fiscaal voordeel heeft een pensioenplan voor mij?

Een derde pijler pensioen geeft de volgende voordelen:

Aftrek van premies binnen je jaarruimte

Je kunt de premies die je betaalt voor je lijfrente fiscaal aftrekken van je belastbaar inkomen. De jaarruimte is sinds 1 januari 2023 verhoogd naar 30 % van het deel van je inkomen waarmee je voor pensioen spaart (voorheen 13,3 %), zo kun je veel meer inbrengen en direct je belastingdruk verlagen.

Inhaal van onbenutte ruimte uit voorgaande jaren

Ongebruikte jaarruimte uit de voorgaande 10 jaar mag je alsnog gebruiken voor extra pensioeninleg (voorheen 7 jaar). Je kunt daarmee een flinke “reserveringsruimte” benutten om in te halen wat je eerder hebt laten liggen.

Box 3-vrijstelling tijdens opbouw

Het vermogen dat je opbouwt binnen een lijfrente-contract valt niet in Box 3. Dit betekent dat je spaargeld en beleggingen voor je pensioen in deze derde pijler niet meetellen voor de vermogensbelasting.

Uitgestelde belastingheffing

Pas op het moment dat je lijfrente-uitkering ingaat, wordt er inkomstenbelasting geheven, vaak in een lagere belastingschijf dan tijdens je werkzame jaren, omdat je inkomen dan doorgaans lager is.

Wat als ik weer bij een werkgever start?

Als je gaat starten bij een nieuwe werkgever, vanuit het zijn van een zelfstandige (ZZP/DGA), blijf je bij het abonnement wat je voorheen had. Dit kan echter veranderen als jouw werkgever Vive afneemt als pensioenregeling, of als deze jou wilt sponsoren, of als deze start met Vive. Dan kun je jouw account weer aanmelden onder de huidige werkgever en veranderd het abonnement naar een sponsoring. Ook veranderd jouw pensioenregeling in ons systeem.

Wat levert Vive mij op als zelfstandigen?

Vive levert zelfstandigen een gemakkelijke manier om niet alleen pensioen op te bouwen, maar ook te beleggen voor hun vermogen.

Toegang tot institutionele ALM-technologie voor vermogensbeheer, normaal voorbehouden aan grote partijen.

Flexibele pensioenoplossing zonder verplichte collectieve regeling.

Fiscaal voordeel op je belastingaangifte, vermindering van jouw belastbaar inkomen en geen vermogensbelasting over de inleg.

Volledige self-service: snel opzetten, zelf beheren en op elk moment aanpassen, zonder dat je een pensioenfonds nodig hebt.

Hoe werkt het sponsoren van pensioen accounts?

Het sponsoren van pensioen voor werknemers kan geheel vrijblijvend gedaan worden. Het houdt in dat je als werkgever een deel van de kosten voor de Vive service en app op jouw bedrijf neemt. Dit zijn de standaard kosten. De beheervergoeding (AuM, Assets Under Management) betalen werknemers zelf.

Let op

Beleggen kent risico's

Investing offers opportunities, but you can lose (part of) your deposit. It is therefore wise to understand the risks involved beforehand. More information about this can be found in the Investment Policy. Vive is a licensed asset manager.