Market update: Second quarter 2023

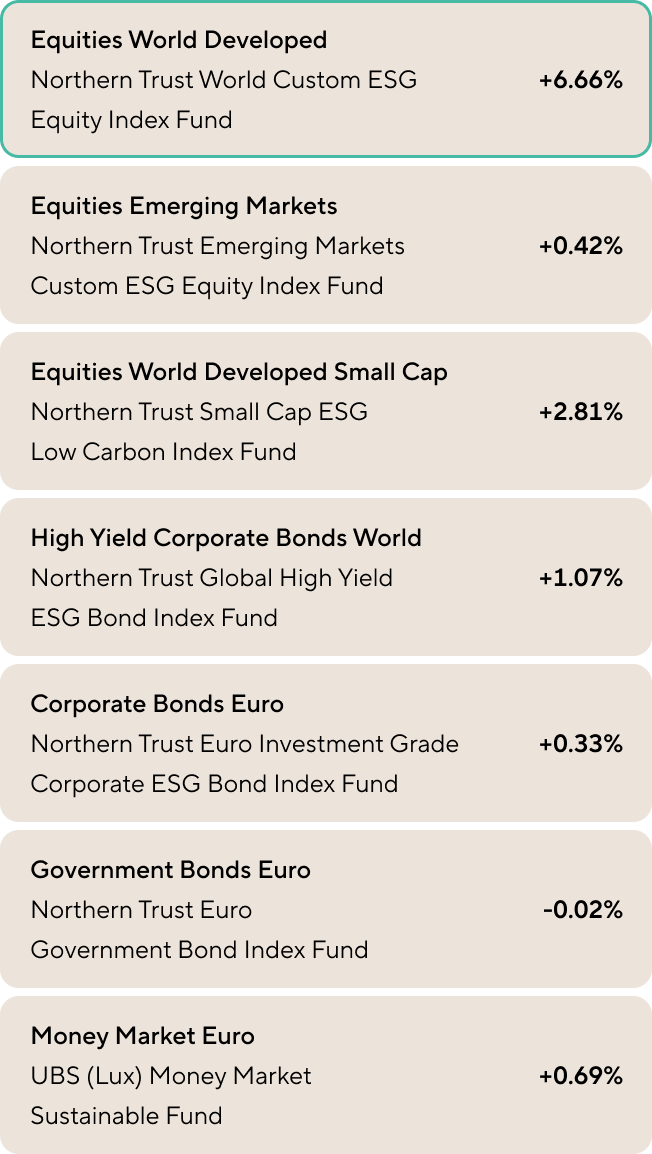

Last quarter brought a positive investment return for the investment categories: equities and corporate loans.

Global equity investments had the highest return: +7%. The bond markets marked time; the return on government bonds in euros was 0%.

Central banks seem to be getting inflation under control. Savings rates are increasing.

Q2 Review: moderate growth, slightly higher interest rates and inflation under control.

Last quarter was relatively quiet on the financial markets. The central banks are keeping the short-term interest rate high to curb inflation. In the Eurozone, the 3-month interest rate is increasing, with 0.65% compared to last quarter, to a level of 3.4%. This higher short-term interest rate is trickling down to savings accounts and money market funds.

The bond markets are anticipating controlled inflation and a stable, higher long-term interest rate. Bonds suffered from the slightly increased long-term interest rate, resulting in a quarterly return of 0%.

The profitability of the business sector showed moderate growth, and combined with interest rate expectations, this resulted in positive equity returns.

We are seeing particular price increases from companies that are committed to growth from artificial intelligence (AI), such as IT companies and computer chip manufacturers.

Stocks in emerging markets lagged behind developed markets. Due to the increasing tensions between China and Taiwan, investors see a higher risk here, and that translates into lower prices.

These two stock markets have a weighting of approximately 30% and 15% respectively of the equity index for emerging markets, so together approximately 45%, and thus dominate this index. Therefore, equity investments in emerging markets are sensitive to this geopolitical risk.

The equity investments that Vive holds for you in your portfolio consist of 80% shares of large listed companies in developed markets, 10% shares of smaller listed companies in developed markets, and 10% shares of listed companies in emerging markets.

This is how we spread the risk; the total return on shares was approximately 6%.

Best fund performance in Q2:

Northern Trust World Custom ESG Equity Index Fund +6.66%

Last quarter brought a positive investment return for the investment categories equities and corporate loans.

Short-term interest rates have risen, so the return for money market funds was slightly higher than last quarter.

The slightly higher long-term interest rates put pressure on the results of bonds and, to a lesser extent, corporate loans.

What does a stable interest rate at a higher level mean?

When inflation is kept in check, and a wage-price spiral is thus prevented, the economy will be able to show moderate growth.

The higher short-term interest rates will hurt companies that are heavily financed with short-term debt; their profitability and solvency may be affected.

The picture for equities is mixed. The question can be asked whether the price rally of AI-related shares is a hype, just like the internet bubble from 1997 to 2001. Across the board, the prospects are moderate.

With stable interest rates at a higher level, bonds will provide a higher return, just like money market funds. Those with money in a savings account will notice that the savings rate has increased.

What does all this mean for my plans?

A higher savings interest rate may make you doubt whether you should sell part of your investments and put them in a savings account.

However, the higher interest rate has a stronger effect on money market investments, and in the long term also on investments in corporate loans and bond investments, than on the savings interest you receive from your bank.

Furthermore, we expect that the future higher interest rate has already been incorporated into share prices, in other words, that investors are focusing on future profits after deduction of higher interest margins.

Therefore, don't let the market disrupt your long-term goals. Vive's investment strategies take into account the risks that are acceptable for your plan.

Check the app to see how you have set your risk level for your investment plans. Movements in the financial markets are not a reason to adjust your risk. However, a change in your personal situation may be.

If you adjust your risk level in such a way that your current investment portfolio needs to be adjusted, Vive will take care of this automatically.

And consistently sticking to your investment strategy with well-diversified portfolios is the key to success in the long term.

Good to know

Vive's expressions are composed to inform and entertain. The content should not be considered financial advice. Asset management involves risks.

maak een afspraak

Klaar voor een moderne oplossing voor pensioen of vermogen? Maak vrijblijvend kennis met Vive en ontdek wat kan - voor jouw organisatie.

Complex pensioen, simpel uitgelegd - weet direct waar je staat

Persoonlijk gesprek voor jouw situatie en die van je werkenemers

In 30 minuten meer duidelijkheid dan uren googlen

Alle ruimte voor vragen aan onze ervaren pensioenexperts