Market update: November 2022

After October already showed some improvement, the momentum in the stock market continued in November. Supported by a positive market sentiment. Based on speculation that the interest rate hikes by central banks have come to an end (whether temporarily or not). Bond yields fell and the US Dollar also fell in value against other currencies.

The World Cup, COP27 and G20 dominated the news in November, while the markets quietly continued to rise. Emerging markets outperformed their Developed counterparts as foreign investors focused on India and China's recovery after a dismal 2022 for the Chinese markets.

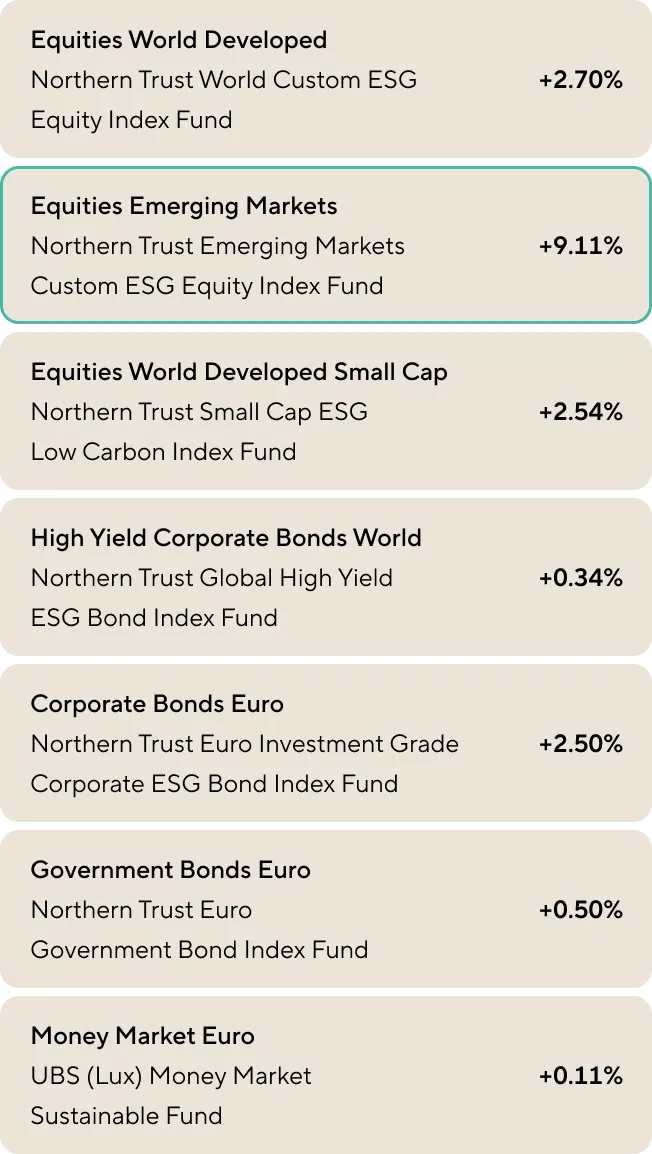

Best fund performance in November 2022:

NT Emerging Markets Custom ESG Equity Index Fund +9.11%

Investors focused their attention on fewer interest rate hikes from central banks and the Chinese market in 2023.

Developed Markets equities are following the positive growth from October, as inflation in the United States showed signs of decline (7.7% YoY) and sentiment among investors improved.

The Federal Reserve (FED) and Bank of England (BoE) increased their interest rate policies by 75 basis points (0.75%) to 4.0% and 3.0% respectively. In a long-awaited speech, Jerome Powell (Chairman of the Federal Reserve) announced that the central bank may scale back the pace of interest rate hikes starting in December. However, Powell cautioned that the fight against inflation is far from over.

Despite the warning, this provided a positive end to the S&P500 (+5%) and Stoxx 600 in Europe (+6.8%).

Despite all the controversy, the World Cup started in October and COP27 concluded with a groundbreaking decision to set up a fund for vulnerable countries that are severely affected by the consequences of climate change.

Emerging Markets equities performed better than their Developed counterparts. Covid-19 restrictions continue to pose a challenge to economic growth in China, but there seems to be light at the end of the tunnel. Investors have the impression that the worst is over. The CSI300 Index rose in November (9.8%). The announcement that China's extreme zero-covid policy is coming to an end seems far away, but had a major impact on the performance of Asia's Emerging Markets equities. India continues to grow and indices once again made 'all time highs'.

US and European 10-year yields fell, with 38 basis points in the US and 21 basis points in Germany. Due to expectations that the pace of interest rate hikes will slow down.

High-yield bonds (+0.34%) and corporate bonds (+0.25%) showed a slightly positive result. And a decrease in the risk premium during the month as market sentiment improved.

The value of the euro against the dollar (EURUSD) revalued 5.4% during the month. This resulted in poorer results, from the euro, on Global Equities and High-Yield Bonds. Money market rates continued to rise in Europe to 1.5%.

What does December have in store?

💬 Another meeting of the FED on December 14 and the ECB on the 12th regarding inflation and possible interest rate hikes.

📫 The Consumer Price Index (CPI) data from the US for November will be published on 12/13 and will give an indication of the expected interest rate hikes in 2023.

What does this mean for my plans?

Don't let the market disrupt your long-term goals. Vive's investment strategies take the up and down market into account. Ultimately, a good plan and diversified portfolios are the key to long-term success. Consistent and periodic investing in periods like these is crucial to benefit in the long term.

Good to know

Vive's expressions are composed to inform and entertain. The content should not be considered financial advice. Investing involves risks.

maak een afspraak

Klaar voor een moderne oplossing voor pensioen of vermogen? Maak vrijblijvend kennis met Vive en ontdek wat kan - voor jouw organisatie.

Complex pensioen, simpel uitgelegd - weet direct waar je staat

Persoonlijk gesprek voor jouw situatie en die van je werkenemers

In 30 minuten meer duidelijkheid dan uren googlen

Alle ruimte voor vragen aan onze ervaren pensioenexperts

.jpeg)