Market update: First quarter 2024

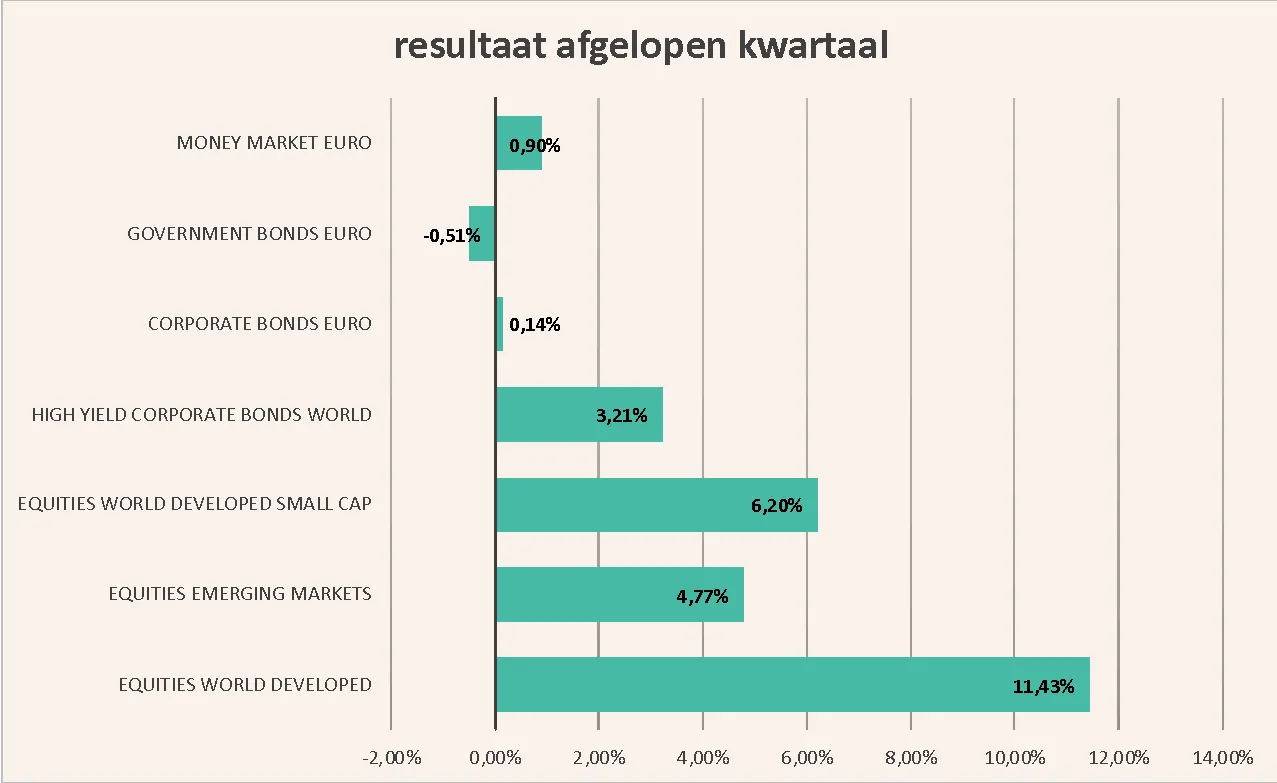

Last quarter was a turbulent quarter for the financial markets. The overall optimism in the market has caused equities to rise to unprecedented heights. Bonds, on the other hand, have experienced challenging months, partly due to persistent inflation figures.

Review of the first quarter of 2024: Optimism in the market despite persistent inflation.

The fourth quarter of 2023 brought positive news due to a higher than expected growth of the economy in the US. This, combined with encouraging global signals of reviving economic growth, ensured that investors were optimistic at the beginning of 2024. Partly as a result, the stock market achieved historically high returns in combination with low volatility. While the stock market experienced high peaks, the bond market stagnated. This is mainly due to persistent inflation figures. Because inflation is not falling, the central banks have indicated that they will lower interest rates less than previously expected. This has caused the returns on the bond market to come to a standstill. This has mainly affected government bonds and corporate bonds from very creditworthy companies. This is because interest rates have a major influence on the return of these safe investments. Corporate bonds with more risk, also known as High Yield corporate bonds, have performed better. This is because these investments also generate returns from the credit risk of companies that are less well regarded.

Best fund performance in the first quarter of 2024:

Northern Trust World Custom ESG Equity Index Fund + 11.43%

Last quarter brought a very positive investment return for equities. Bonds did less well, where especially corporate bonds from well-regarded companies and government bonds did less well. The equity portfolio as a whole showed a return of 10.2%.

Historically high peaks in the stock market, what does that mean for my portfolio?

The stock market has performed exceptionally well in the past quarter. However, the sentiment in the market is that the stock market will fall again in the near future. According to Nobel Prize winner Robert Shiller, the prices of American stocks have increased more than the profits of the underlying companies. This could lead to a downward correction in the stock market. "When prices run too far ahead of profits, there will eventually be a correction," he states.

Do you have to act on this and adjust your portfolio accordingly, for example by selling your shares? No! The Vive investment model ensures that your portfolio is diversified as optimally as possible for your risk level. This means that this type of unrest will have little effect across the board of your portfolio. Moreover, it has been scientifically proven that it is almost impossible to time the market, which means trying to predict when the stock market will fall. There is a good chance that you will miss out on returns if you do this.

Robert Shiller's advice is: use low-cost index funds to include the entire stock and bond market in your portfolio and hold on to them.

This aligns seamlessly with Vive's message. We will repeat it once more: don't let the market disrupt your long-term goals. Vive's investment strategies take into account the risks that are acceptable for your plan. Check the app to see how you have set your acceptable risk level for your investment plans. Movements in financial markets are not a reason to adjust your risk. A change in your personal situation may be.

If you adjust your acceptable risk level in such a way that your current investment portfolio needs to be adjusted, Vive will take care of this automatically. And consistently sticking to your investment strategy with well-diversified portfolios is the key to long-term success.

maak een afspraak

Klaar voor een moderne oplossing voor pensioen of vermogen? Maak vrijblijvend kennis met Vive en ontdek wat kan - voor jouw organisatie.

Complex pensioen, simpel uitgelegd - weet direct waar je staat

Persoonlijk gesprek voor jouw situatie en die van je werkenemers

In 30 minuten meer duidelijkheid dan uren googlen

Alle ruimte voor vragen aan onze ervaren pensioenexperts