Market update: Third quarter 2023

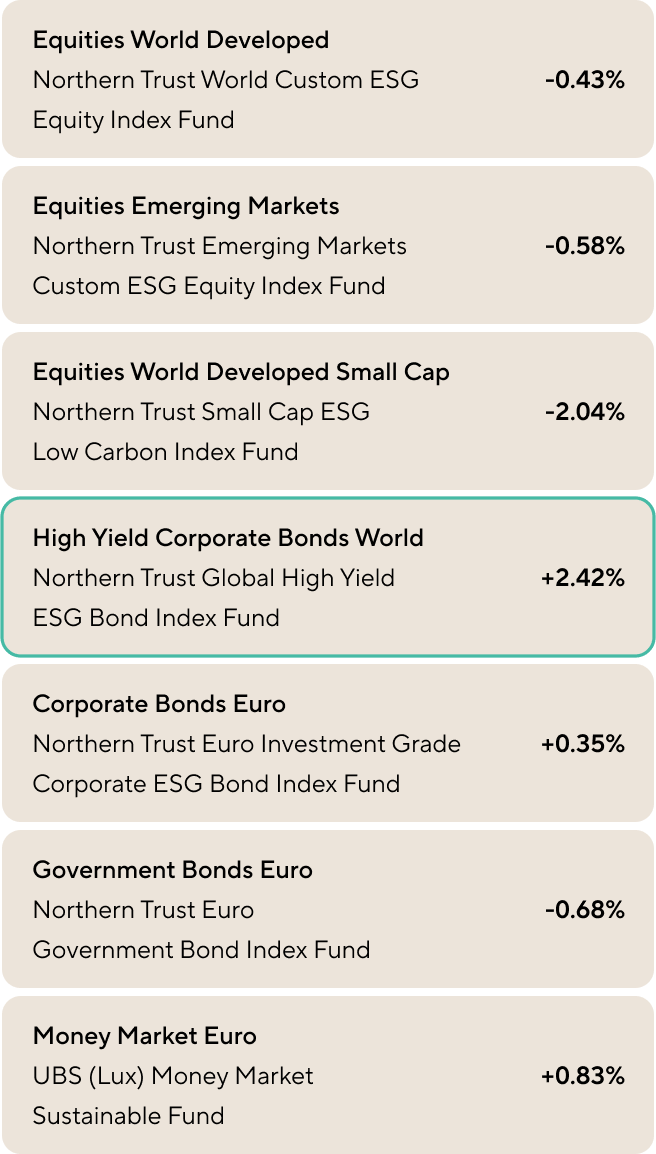

Last quarter was a challenging quarter for equities, with a return decline of -0.6%. Only money market investments and corporate bonds showed a positive investment return. The continued rise in interest rates could slow down economic growth and corporate profits, leading to increasing uncertainty in the financial markets. But what does this mean for your investment plans?

Review of the third quarter of 2023: Expected growth slowdown due to interest rate increases

Central banks also raised short-term interest rates last quarter to control inflation. The American central bank raised interest rates by 0.25%. In the Eurozone, the 3-month interest rate rose slightly by 0.3% compared to the previous quarter, to a level of 3.7%. The further increase in interest rates made investors realize last quarter that this could slow down economic growth, which could also lead to lower corporate profits. That is bad news for stocks, which showed a decline in value worldwide. Investors are anticipating high interest rates in the future, which caused the value of government bonds to fall. The volatility of the stock markets is increasing, which indicates more uncertainty about future developments.

Best fund performance in the third quarter of 2023:

Northern Trust Global High Yield ESG Bond Index Fund +2.42%

Last quarter brought a positive investment return for the investment categories money market investments and corporate loans. The high-yield corporate loans showed the highest return, with European corporate loans outperforming the American ones last quarter. The short-term interest rate has risen, so the return for money market funds was slightly higher than last quarter. Based on the current interest rate, the return on money market funds for 2023 would be 2.9%, which is more than what many savings banks offer in interest.

More uncertainty in the financial markets, what does that mean?

We are seeing an increase in the VIX index, which measures the expected future volatility of stock prices. This means that uncertainty in the financial markets is increasing. Should you radically reduce the risk profile of your investment plan so that you give up all your equity investments? No! History teaches us that you cannot predict in advance when stock prices will fall or rise. The only way to reap the long-term return on equities is to continue investing in them patiently.

We keep repeating our message: don't let the market disrupt your long-term goals. Vive's investment strategies take into account the risks that are acceptable for your plan. Check the app to see how you have set your acceptable risk level for your investment plans. The movements in the financial markets are not a reason to adjust your risk. However, a change in your personal situation may be.

If you adjust your acceptable risk level in such a way that your current investment portfolio needs to be adjusted, Vive will take care of this automatically. And consistently sticking to your investment strategy with well-diversified portfolios is the key to long-term success.

maak een afspraak

Klaar voor een moderne oplossing voor pensioen of vermogen? Maak vrijblijvend kennis met Vive en ontdek wat kan - voor jouw organisatie.

Complex pensioen, simpel uitgelegd - weet direct waar je staat

Persoonlijk gesprek voor jouw situatie en die van je werkenemers

In 30 minuten meer duidelijkheid dan uren googlen

Alle ruimte voor vragen aan onze ervaren pensioenexperts

.webp)